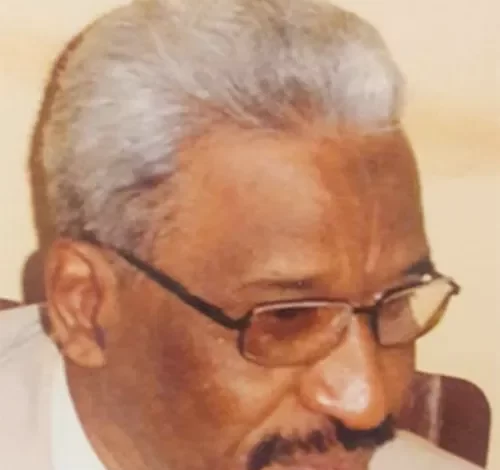

Former SG of Tax Authority presents proposals to increase State Revenues

Sudan Events – Rehab Abdullah

Former Secretary-General of the Tax Authority, Ahmed Adam Salem, called on the Ministry of Finance to adopt unconventional financial and monetary policies to confront the state’s revenue shortage, describing it in his interview to (Sudan Events ), on Sunday, as a major and unprecedented economic challenge, so that these policies would be reflected in increasing revenues, turning the wheel of production and carrying out the reconstruction process of what was destroyed by the war.

Salem believed that the biggest challenge facing the 2024 budget is working to increase revenues from fees and taxes in such exceptional circumstances that Sudan is experiencing.

He explained that it is known that the state’s own revenues are obtained from taxes, customs, service fees, property revenues, and state investments from institutions of a revenue nature, but he recommended that the Ministry of Finance in this case change the financial policy in collecting taxes, customs, and fees to an indirect tax policy that is taken from capital at a specific percentage, such as value added, customs fees, and production fees, and work to disregard direct taxes and local fees, stipulating that the prescribed percentage is reasonable and acceptable so that the taxpayer can pay it because increasing revenues in the state in such circumstances depends on reducing fees and taxes, indicating that when fees are reduced, the rate of smuggling and evasion of paying taxes and fees decreases, the tax umbrella expands, the administrative cost of the collection process decreases, and the revenue proceeds increase.

He called on the Ministry of Finance to issue a decision to collect a specific percentage of the internal transportation and deportation manifesto once at the starting point of deportation, and accordingly it is prohibited to impose or collect any other fees on goods, merchandise, and services,

provided that the states are granted a percentage of customs revenues, value added, and services, after agreement is reached on this according to specific and agreed upon criteria.

Salem pointed out that to increase revenues, the Ministry of Finance must work to raise fees for public services such as fees for identification documents, licenses, courts, communications, etc.

He explained that one of the most important sources of revenue for the state in these circumstances is to increase gold production and control it because most of the gold is produced in the safe states of the North, the River Nile , and eastern Sudan, and to take strict measures to prevent gold smuggling and organize the marketing process and complete control over gold exports and control the exploitation of export revenues by reducing and rationalizing the import bill, while increasing and securing oil production and fees for the export of oil from the southern state, and encouraging international companies to enter the oil industry and other minerals with quick and profitable returns in the safe states, by following such a financial policy, the Ministry of Finance can increase the proceeds of self-revenues.

Salem stressed that one of the challenges facing the state and the Ministry of Finance after the end of the war is the process of rebuilding the infrastructure, service facilities, and basic services destroyed by the war, and the damage and destruction inflicted on schools, homes, hospitals, factories, bridges, roads, etc., taking into account the failure of most of the experiences of the international community and donor countries in supporting the reconstruction process in countries that were exposed to the same thing that Sudan was exposed to before.

He saw the need for the state and the Ministry of Finance not to rely too much on the outside in the post-war reconstruction process, and if funding or money is available from donors, the Ministry of Finance should manage it well by setting the necessary financial controls that protect it from corruption and ensure its disbursement to achieve the public interest, and they should follow a policy of self-reliance and adopt a scientific approach in economic feasibility studies for projects.

He suggested that the state start by reconstructing the traditional production sector, in which more than 70% of the Sudanese people work, then by raising the capabilities and effectiveness of the Sudanese private sector and encouraging it by investing in the reconstruction of some infrastructure and service projects with long-term financing and entering into strategic partnerships with businessmen, companies and financial institutions globally, while urging businessmen and the private sector to support the state in the field of basic services and help alleviate the living suffering of citizens through donations and gifts, in addition to directing the banking sector to provide the necessary funding for reconstruction projects and attracting the savings of expatriates and encouraging them to enter into projects with economic feasibility in the field of reconstruction projects.