Chamber of Commerce: Free Zones Contribute to Economic Development

Sudan Events – Nahed Oshi

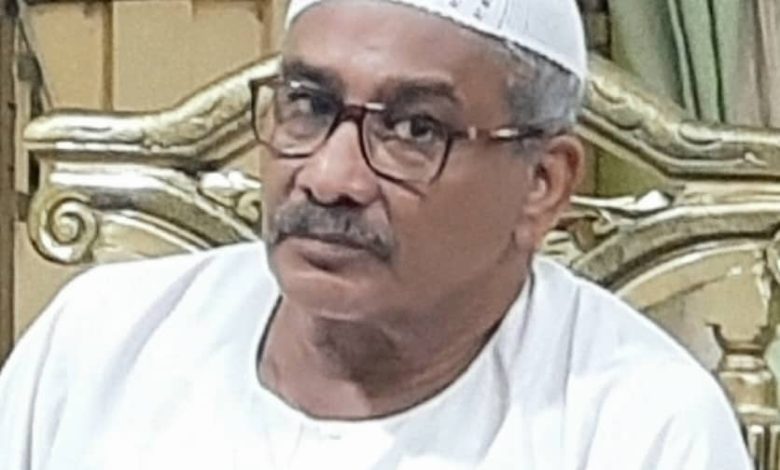

The Secretary-General of the Chamber of Commerce, Atbara, Saif Al-Din Moqled emphasized the importance of establishing a free zone in Atbara to contribute to the process of economic, commercial and social development.

In his speech to (Al-Ahdath), he mentioned the ability of the Atbara Free Zone to compensate for the loss of the two civilian village areas due to their being out of service as a result of the consequences of the ongoing war.

He said that the establishment of a free zone will attract foreign investments through exemptions and incentives provided by the state, and this will reflect the strengthening of relations between regional and global countries.

Which helps in increasing the state’s exports and thus bringing in hard currency, which is used for growth, development and development. Also, through the operation of this free zone, it requires workers with trained technical expertise to operate it, which helps provide job opportunities for young people of 45,565 genders, and to gain experience for workers and train them, which helps in qualifying imports. Technology, technical and administrative expertise, the free zone promotes the use of local production in re-export and import operations, which reflects positively on the economy, and development and growth in the various services, transport and deportation sectors.

Pointing out that the city of Atbara, with its strategic location, distinguished by its proximity to sea ports, land crossings, and air ports, makes it capable of having a free zone that plays its full role to push towards development and development, in addition to the availability of labor infrastructure with distinguished expertise and high technical capabilities.

Pointing out that the free zones are part of the state’s territory in which it is allowed to import, store and re-export foreign goods, and to practice commercial and industrial business with exemption from customs duties and taxes imposed within the state within the limits determined by the law.