Lifting Ban on Companies, Demands Central Bank to Practice Transparency

Report – Rehab Abdullah

In just two months, the Central Bank of Sudan issued more than three decisions related to export companies. In March of this year, it issued a decision banning 209 export companies with a banking ban. Then it came back and issued a decision to give export companies a grace period of two months to return their export proceeds according to new “temporary” procedures that stipulated by granting 225 companies operating in the field of faulted exports a period of two months to recover their faulted export revenues, starting from the first of this May.

Lifting a ban:

The Central Bank of Sudan announced the lifting of the ban on 163 companies, effective from May 1 until June 30. The Central Bank justified the move in light of the current circumstances and the exceptional conditions that the country is going through.

The Central Bank banned 209 companies in March of the current year, 2024, and attributed the ban at that time to their failure to pay export revenues for previous periods, so that they would return to work again in the field of export and import.

At a time when economists criticized the conflicting decisions of the Bank of Sudan, between banning and then lifting it without giving reasons, they considered such decisions to harm the flow of exports and also make the Central Bank lose its credibility regarding the decisions it issues. They stressed that stopping companies during the war period harms the state’s revenues at the time, in which they stressed the need to establish strict controls that guarantee the entry of exports without harming revenues or companies.

Welcome to work:

Head of the Gum Arabic Exporters Division, Ahmed Al-Annan, welcomed the lifting of the ban on 163 companies, i.e. 80% of the recently banned companies, and allowing them to carry out their work for a period of two months. He expressed his hope that the ban would be lifted on the remaining ones and they would resume work.

In his speech to (Sudan Events), Al-Annan confirmed the impact of the decision to ban companies on the position of exporters and importers, but he described the decision to allow work to be carried out for a period of two months and to supply the proceeds and then work in a sustainable manner (a successful step). He saw that it contributes to the flow of exports and called for always flexibility in work and an attempt to address problems by consensus, appreciating the interest of exporters and the interest of the state.

Companies that have been banned:

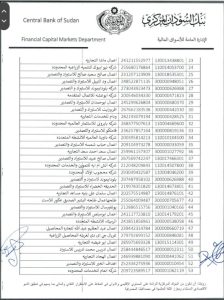

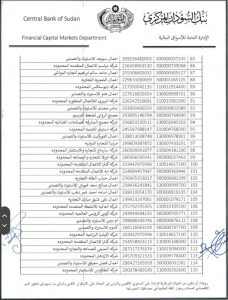

The list obtained by Sudan Events included Semsem Integrated Solutions Company Limited, Mubadala Company for Multiple Activities, Ibrahim Al-Hilali Import and Export Company, Murooj Commodities Company Limited, Bashir shi Livestock Trading Company, Mahjoub Sons Company Limited, the Central Commercial Company, and others, amounting to 163 companies.

Ambiguity and obscurity :

Economist Dr. Mohammad Al-Nayer believes that the vision and transparency must be clear, and he considered clarity a very important issue in light of the current circumstances. He pointed out in his interview with (Sudan Events) that when the Central Bank announced the ban on companies, it made it clear that the reasons were due to the lack of supply of export proceeds, and when it announced lifting the ban had to clarify whether there is a payment of the issued proceeds? Or is there a commitment to pay within a specific period of time? What is the mechanism by which the ban was lifted? Al-Nayer considered that there was complete ambiguity and lack of clarity of vision, and called on the Central Bank to clarify on what basis the ban was lifted for 163 companies to return to work, indicating the necessity of disclosure if a treatment or agreement had been reached and announcing it to public opinion. In order to be aware, he pointed out that the current stage needs to take into account the circumstances of companies in war conditions, but he stressed the necessity of not being complacent and giving up the state’s right to have export revenues come at the specified time or after the period that was allowed, and he stressed the need for there to be Strict measures preserve the state’s right because the delay in export revenues is one of the factors and reasons that led to the fundamental decline in the value of the national currency, in addition to the need to mobilize the expatriate sector and urge them to transfer their savings domestically through official channels so that the country can benefit from them greatly.