Economic

The Return of Chinese Oil Companies: Mutual Gains

Report by Rehab Abdullah

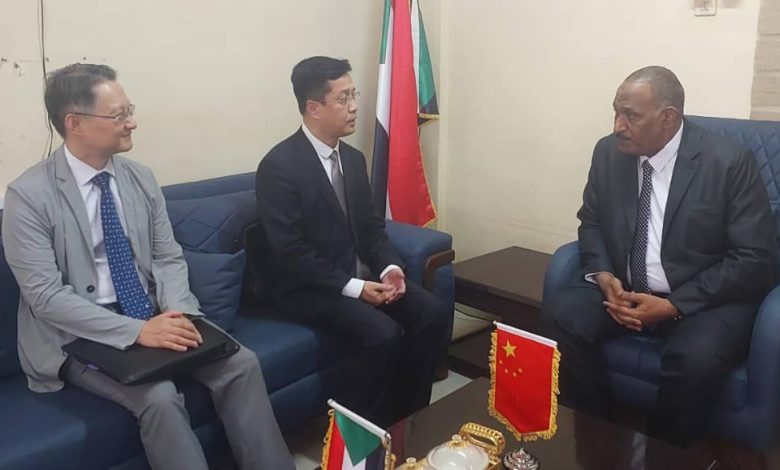

The Higher Committee for Enhancing Cooperation with China has begun its mission by identifying areas of mutual cooperation and developing policies and procedures to strengthen and expand partnerships between the two countries in ways that serve mutual interests and enhance strategic relations. The committee, headed by Dr. Jibril Ibrahim, Minister of Finance, held its first meeting with relevant ministries and the Central Bank of Sudan. They initiated the implementation of outcomes from the Chairman of the Sovereign Council’s participation in the China-Africa Cooperation Forum Summit held in China from September 3 to 6, focusing on political, economic, and security cooperation. One of the main priorities for Sudan is the return of oil companies to operate in the country, after their previous exit under the previous government, which remained silent on the reasons for their departure.

Decline in Sudanese-Chinese Cooperation

In this context, Minister of Oil and Energy, Dr. Mohieddin Al-Naeem, attributed the decline in Sudan-China oil cooperation to the period when the Forces of Freedom and Change were in power. He indicated that the recent visit helped resolve this issue and restore constructive partnerships in the sector. Al-Naeem revealed productive discussions with China that pave the way for new partnerships in oil and related investments. He added, during a recent “Radio Conference” program, that meetings on the sidelines of the China-Africa Cooperation Forum reestablished active communication with the China National Petroleum Corporation, which had played a major role in establishing Sudan’s oil infrastructure.

Oil Company Debts

Former Minister of Energy, Engineer Ishaq Jamaa, noted that the meeting between General Abdel Fattah al-Burhan, Chairman of the Sovereign Council, and Chinese companies marks the beginning of the road for Chinese oil companies to resume operations in Sudan post-conflict. However, he stressed that technical and financial work is needed to settle the obligations of both parties and bring strategic relations in line with the current political climate. Jamaa suggested forming a team of capable technicians and knowledgeable politicians to handle this file, starting from the current state of the war and post-war phase. He also emphasized that this should not be left solely to the Ministries of Finance and Oil, as they are preoccupied with daily management and lack the time or strategic planning focus. The team should include these ministries, with the task of studying China’s precise and practical intentions amid fluctuating relations.

Jamaa also highlighted that issues with Chinese companies predate the war, particularly after the secession of South Sudan, which took 75% of the oil production. Sudan retained 120,000 barrels per day, of which 50% was owned by Chinese and other Asian companies, as per agreements allowing for purchases. However, debts remained unpaid, and there was no financial mechanism to reschedule them. This was the responsibility of the Ministry of Finance. Consequently, companies opted to halt operations and withdraw from oil projects. Jamaa added that during his short tenure as Energy Minister in the government of Mohamed Tahir Ayala, they requested time to take charge of the ministry and explore ways to ensure continuity. However, the December revolution—hijacked early on by foreign agents—prioritized eliminating Chinese interests, especially in oil, despite their pivotal role in the sector. He pointed out that Chevron, the American company, conducted initial explorations but was barred from extraction due to the policies of major powers like the U.S. Jamaa suggested that the goal was to prevent Sudan from achieving economic development through oil, using tools such as falling oil prices and conflicts in South Sudan.

Multiple Gains

Oil expert Engineer Abdelhay Ali Hamed confirmed the possibility of Chinese oil companies returning to Sudan, stating that Chinese investments are bold. Hamed dismissed concerns over debts, explaining that the companies recover their dues through profit-sharing or production-sharing agreements, receiving their payments in crude or products. He asserted that misinformation has been spread about “debt.”

Positive Impact

Economist Dr. Mohamed El-Nayer emphasized that the return of Sudanese-Chinese cooperation will have a positive impact on Sudan’s economy. El-Nayer noted that this step was long overdue, arguing that Sudan should have worked harder to bring back Chinese investments. He recalled that China played a crucial role in developing Sudan’s oil industry, which boosted the country’s production to 480,000 barrels per day before South Sudan’s secession. This had a significant positive impact on Sudan’s economy. El-Nayer expects that the resumption of Chinese investments in both the oil and mining sectors will further bolster Sudan’s economic recovery.

Timing Significance

El-Nayer told Al-Ahdath that this development comes at a critical time. Sudan is currently in the midst of a war and economic instability. The signing of agreements and MoUs in Beijing during such conditions is a positive sign. He believes it will play a major role in rebuilding infrastructure and productive sectors, and anticipates intensified efforts in the near future to implement these agreements and strengthen Sudan-China relations. He added that Sudan’s ties with China, Russia, and the BRICS group will provide the country with significant support in international forums.