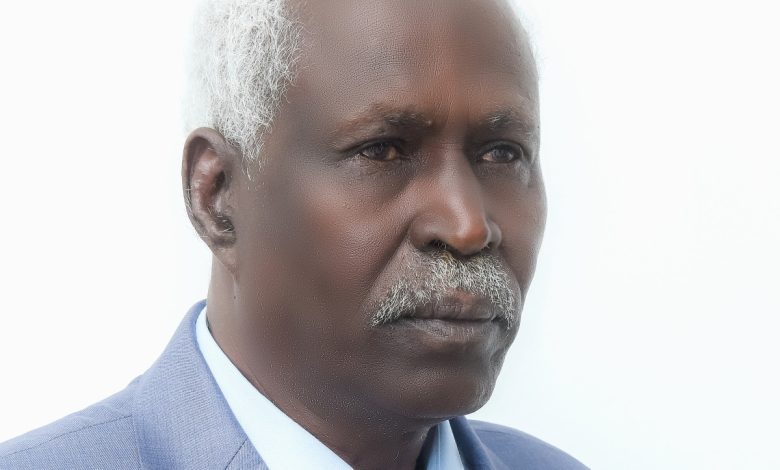

The General Manager of Nilein Bank, Osman Adam Hamid, in an exclusive interview with “Hawas Magazine”

What is the fate of Nilein Bank in Abu Dhabi…!!*

Banks also possess high production capacity, and with the use of advanced technology, this capacity can become almost unlimited.

– Most banks suffer from small capital bases, limiting their ability to expand internationally and obtain banking facilities from foreign correspondent banks.

– Banks have not achieved the desired success in financial intermediation, ranking low globally based on the ratio of bank deposits to GDP (Gross Domestic Product).

– Banks both influence and are influenced by macroeconomic indicators, and they remain responsible for improving these indicators in collaboration with relevant authorities.

– The relationship between stakeholders must be based on a win-win methodology to remain sustainable. This means fairly sharing the returns of the organization.

The clear reality is that depositors, who are the largest and most important partners, are losing, and from their losses, others might profit. This is the root of the problem that requires a solution.

– The banking sector suffers from an excess of banks and a lack of branches, which leads to weak financial inclusion, especially in rural areas.

It’s well known that the informal economy represents a large portion of the overall economy, requiring banks to collaborate with relevant authorities to integrate it into the formal economy. This situation has caused a significant amount of currency to remain outside commercial banks.

To address the challenges of the post-war period, I believe each bank’s board of directors should implement a comprehensive institutional reform program. This program should be executed decisively and effectively, and it would be ideal if it were based on a credit rating from an internationally recognized firm. Some of the key components of this program include:

– Increasing capital

is an urgent necessity, whether through converting state-owned banks into public joint-stock companies after reforming them, issuing new shares, or seeking strategic partners (domestically or internationally). However, it is preferable to achieve this through voluntary mergers, as only large entities will have a future and be able to compete in international banking markets. We have seen many global banks voluntarily merge; unity brings strength and resilience. It’s time to overcome the stigma of our previous forced banking mergers.

– Developing and enhancing human resources

especially since they are the leading factor rather than a lagging one in internal organizational success.

– Staying ahead in banking technology

is crucial. No bank has a future without a competitive advantage in this area. As Bill Gates once said, “Banking is necessary, banks are not.” This statement highlights the importance of technology as the world enters the digital age.

– Finally, the banking sector is the largest and most important sector in any economy. Therefore, it must be reformed swiftly so that it can play its strategic role in sustainable development.