Issuing New Currency Denominations: Pros and Cons

Report by: Rehab Abdullah

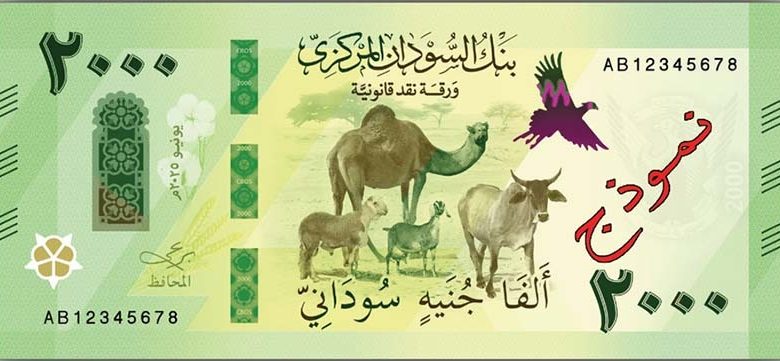

In a surprising move, the Central Bank of Sudan announced the release of a second edition of the 500-pound banknote and the introduction of a 2,000-pound note, joining the 1,000-pound denomination that was issued during the currency replacement process across eight states in December 2024. Both new notes bear the signature of former Central Bank Governor Barai Al-Sadiq, dated June 2025.

The announcement came as a surprise because, just recently, an image of the 2,000-pound note was leaked and subsequently denied by authorities, citing the ongoing war and fragile economic conditions as reasons to postpone any new currency issuance. The move also raised questions, as several areas recently liberated from the Rapid Support Forces have yet to undergo the currency replacement process—an issue that has created numerous logistical and economic challenges.

This decision comes at a time when the Sudanese pound has lost more than 560% of its value against foreign currencies. The U.S. dollar currently trades at 3,700 pounds in the parallel market, compared to 560 pounds in mid-April 2023, when the war began.

The Potential Benefits

Former First Deputy Governor of the Central Bank, Dr. Badr Al-Din Qureshi, stated that issuing new 2,000 and 500-pound notes could help alleviate cash shortages in the short term and facilitate currency replacement in war-affected regions.

However, he cautioned that in the medium and long term, such measures could encourage a cash-hoarding culture, discourage the use of digital payment systems, and fuel unregulated market activities such as speculative trading in foreign exchange, vehicles, land, and real estate.

Warnings and Risks

Banking expert Walid Dalil warned that issuing new currency must be backed by sufficient reserves or monetary cover to maintain confidence in the currency. He explained that excessive money printing without backing leads to inflation and currency devaluation.

Dalil stressed that printing money is not inherently problematic if it is supported by real production and economic assets—but becomes dangerous when not matched by genuine economic growth or reserves.

He outlined several potential forms of monetary backing:

Gold or precious metal reserves

Foreign currency reserves

Domestic production and economic assets

Government revenues and taxation

Loans and external financing

What Happens Without Monetary Backing?

According to Dalil, the absence of adequate backing for printed money leads to:

Hyperinflation: Excess money supply without corresponding production drives prices sharply upward.

Loss of public confidence: Citizens prefer holding foreign currencies or gold.

Currency depreciation: The local currency loses value against others.

Economic crises: Declining purchasing power, rising poverty, and higher unemployment.

To mitigate these risks, he recommended:

Balancing money supply with domestic production.

Strengthening reserves of gold and foreign currency.

Expanding exports and government revenues.

Practicing responsible monetary management and avoiding unbacked printing.

Large Denominations: A Symptom, Not a Solution

Banking strategist and business development expert Ayman Jawish argued that issuing high-value denominations is a symptom of economic distress rather than a solution. Speaking to Al-Ahdath, he said true reform requires addressing the structural causes of inflation—such as weak production, fiscal deficits, and poor monetary policy management.

“Confidence in a currency is built through reform, not printing,” he emphasized.

Jawish explained that while governments in crisis often issue large denominations to ease transactions, such moves usually reflect the depth of economic collapse rather than remedy it.

“In countries facing hyperinflation and currency collapse,” he said, “issuing 50,000 or 100,000-unit notes often signals loss of purchasing power and lack of structural solutions.”

He cited historical examples:

Zimbabwe (2008): Issued a 100-trillion-dollar note amid 79 billion percent inflation.

Venezuela: Introduced a 1 million bolívar note after economic collapse and hyperinflation.

Sudan: Recently introduced a 1,000-pound note amid persistent devaluation and soaring prices.

Economic Theories at Play

Jawish noted that:

Quantity Theory of Money posits that increasing money supply without matching production leads to inflation.

Rational Expectations Theory suggests people anticipate continued inflation, weakening monetary policy impact.

Monetary Confidence Theory holds that trust in a currency depends on its stability—something undermined by issuing large denominations.

Expert Insight: Temporary Relief, Structural Challenge

Economist Dr. Mohamed Al-Nair said issuing new denominations continues the partial currency reform that began with the 1,000-pound note. He explained that smaller denominations (100 and 200 pounds) have lost purchasing power and are becoming obsolete.

While the new notes might temporarily ease liquidity pressures, Al-Nair warned of potential inflationary side effects if not carefully managed. He urged the Central Bank to inject the new currency with precise calculations to avoid reversing progress in digital banking adoption, which many citizens now rely on.

He expressed concern that the 2,000-pound note could encourage cash hoarding, pulling liquidity out of the banking system—an issue that plagued the economy before the war, when over 90% of money circulated outside banks.

Al-Nair emphasized that during wartime, keeping large sums of cash at home exposes people to theft and loss. He suggested that authorities could use this as a public-awareness opportunity.

Looking ahead, he recommended a comprehensive currency reform by early 2026, even if complete replacement is delayed—potentially involving removing zeros to restore the value and usability of lower denominations.

He concluded that restructuring the denomination system is essential for economic correction, aligning with the Central Bank’s 2025 Monetary Policy, which already calls for a full review of the national currency structure.