President of the Sudanese Insurance and Reinsurance Companies Union, Tamader Abu Al-Qasim, to Sudan Event: Announces the non-liability of any company for compensating war damages, and reveals the losses incurred by insurance companies due to the war

– Insurance companies are also looking for a party to compensate for their losses

– Due to the war, insurance companies have cancelled their agreements in the Sudanese market

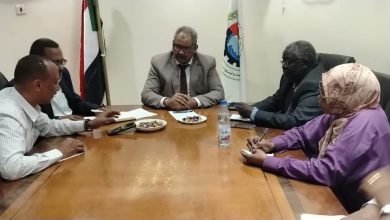

Interview conducted by Rehab Abdullah

Tamader Abu Al-Qasim, President of the Sudanese Insurance and Reinsurance Companies Union and General Manager of Al-Salam Insurance Company, revealed that insurance companies have incurred significant losses due to the war in Khartoum. These losses include the loss of assets and the cessation of operations in the capital and the states affected by the war. The extent of these losses is still being assessed, including the evaluation of company property losses, missing premiums, and investment returns.

Q. How has the war between the Rapid Support Forces and the Sudanese Army on April 15th of this year affected insurance companies in Sudan?

A. Insurance companies have incurred significant losses, particularly the loss of assets and the suspension of operations in the capital and the states affected by the war. More than 80% of insurance premiums were in the capital, and the headquarters and branches of companies in western Sudan were looted. Additionally, due to this prolonged war, salaries of company employees and all stakeholders, including policyholders, shareholders, agents, and others, have been suspended.

Q. What is the approximate amount of losses incurred by insurance companies?

A. Work is ongoing to assess company property losses, missing premiums, and investment returns. Regarding the role of companies in compensating for losses, Tamader, President of the Insurance Companies Union, emphasised that insurance companies themselves are looking for parties to compensate them. It is a common practice that insurance policies and reinsurance companies exclude war risks, whether declared or undeclared.

One of the reinsurance companies had cancelled its agreements in the Sudanese market due to the war, which poses a significant problem for insurance companies despite the fact that no company is liable for compensating war damages.

Q. So, which is the entity that can compensate the affected individuals?

A. There is a fund called the Arab War Risk Insurance Fund, which is the only entity that could have covered war risks if there was a request from any policyholder for war coverage before April 15th. However, due to the outbreak of war in Sudan and the increase in coverage costs, policyholders refrained from seeking war risk coverage. After the end of this war, we expect the state to follow the natural course, as is customary worldwide, by establishing a fund that receives regional and international support to rebuild what the war has destroyed. This fund would compensate citizens, businessmen, and all financial institutions to ensure that insurance companies can continue their normal operations. In ordinary circumstances, insurance companies have compensated thousands of policyholders and helped prevent economic activity from coming to a halt.

Q. Is there a need for further development of insurance companies?

A. Unfortunately, insurance companies have been marginalised in previous years and not actively involved in policies and decisions that serve the insurance sector and enhance performance despite having experts and valuable experience as members of the Insurance Companies Union. What hampers any economic institution in developing countries is the trial-and-error approach by authorities that make influential decisions without conducting studies and learning from advanced countries’ experiences as performance improvement models.

The greatest tragedy that affected the insurance market is the lack of enforcement of supervision and control laws in insurance. The vacuum left by the absence of a board of directors for the supervisory authority for over three years and the absence of a board of trustees for the Insurance Policyholders’ Guarantee Fund until now have contributed to this situation.

Q. What is the Insurance Policyholders’ Guarantee Fund, and what role does it play?

A. The fund is where insurance companies pay annual contributions as a percentage of the premiums they collect. It is managed by the board of trustees, including representatives from the Insurance Companies Union, other experts, Sharia-compliant oversight, and the Secretary-General of the National Insurance Authority.

The role of the fund is to compensate policyholders in case any insurance company is unable to fulfil its obligations and compensate its clients for covered risks. However, it is a condition that there is no negligence or intention to avoid payment by the insurance company, and the fund assists insurance companies until they rectify their situations and reimburse the amounts to the fund.

Currently, some insurance companies’ operations in certain states cannot reach their missing premiums due to the war, and this will also negatively affect their ability to renew reinsurance agreements for the next year.

The greatest tragedy that affected the insurance market is the lack of enforcement of supervision and control laws in insurance. The vacuum left by the absence of a board of directors for the supervisory authority for over three years and the absence of a board of trustees for the Insurance Policyholders’ Guarantee Fund until now have contributed to this situation.

Q. What is the Insurance Document Holders’ Guarantee Fund?

A. It is a fund where insurance companies pay annual contributions representing a percentage of the premiums they collect. This fund is managed by a board of trustees, overseen by the Insurance Companies Association, and typically includes a seat for the Insurance Companies Association in this board, along with other experts, Sharia supervision, and the General Secretary of the National Insurance Supervision Authority.

Q. What is its role?

A. The fund’s role is to compensate policyholders if any insurance company cannot fulfil its obligations and compensate its clients for covered risks. However, this is contingent on there being no negligence or intentional non-payment by the company. In other words, insurance companies cooperate until their situations improve and they can repay the amounts to the fund. Furthermore, when any insurance companies are liquidated, the fund’s board of trustees does not have the right to dispose of the fund’s assets, contrary to what was mentioned, as per the regulations stated in the insurance supervision and control law.