Sudan due debts to China – War undermines repayment strategy

Report – Rehab Abdullah

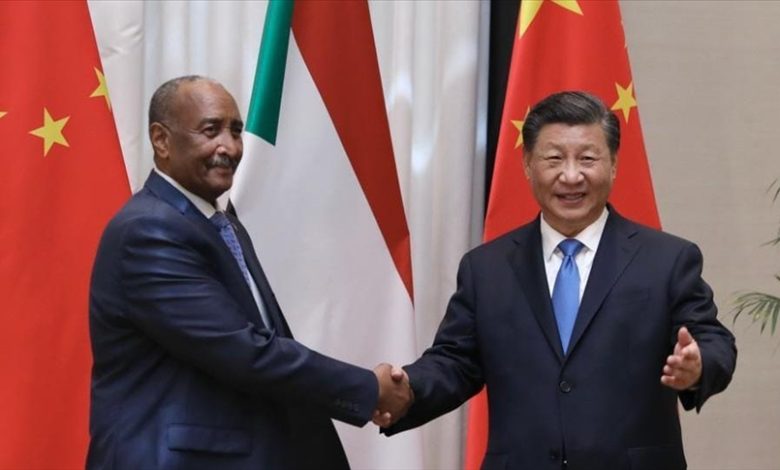

The Vice President of the Sovereign Council of Sudan, Malik Agar, revealed that Sudan and China have reached understanding to increase and expand Chinese investments in Sudan and increase oil production in addition to investing in the field of renewable energy. These understandings were reached during his visit to the Chinese capital, Beijing.

The Sudan delegation met with the Director General of the China National Petroleum Company (CNPC) and held discussions for its return to Sudan and the resumption of its work again.

A new strategy on payment of debs

At the same time Finance Minister Gibril Ibrahim, who accompanied him on the mission, announced that the Sudanese government has developed a new strategy to repay Chinese debts, which includes increasing investment in the oil sector.

In this regard, there were many questions about the possibility of Sudan repaying Chinese debts at the present time, when Sudan is living a war situation between the army and the rebel Rapid Support militia, as well as the possibility of the giant Chinese company returning to resume its activity in Sudan.

The size of Chinese debt

China’s debts to Sudan, according to what the Central Bank of Sudan announced, amounts to US$ 5.12 billion, but observers pointed out that this does not include oil prepayment facilities – which are essentially loans that will be repaid in kind, oil.

Economists attribute the accumulation of China’s debts on Sudan to the Sudanese Ministry of Finance’s failure to pay the dues of Chinese companies. The evidence is that the cessation of Chinese financing projects in Sudan is considered as one of the direct repercussions of the debt crisis between the two countries, which the government in Khartoum is trying to redress.

Original story

The former Petroleum Minister explains:

Consultant engineer Ishaq Bashir said that the debts of China and CNPC stemmed from the fact that the company that explored oil in Sudan was Chevron, but for global economic reasons and the decline in oil prices from US$30 per barrel to US$20 per barrel at that time, Chevron stopped its oil extraction project. This was partly because of change in the political situation, 1989 in Sudan, and China’s need for energy in its rapid development and its desire to enter Africa, as well as the expiration of the exploration license for the Chevron Company in 1990. Ishaq told (Sudan Events) that according to the regime existing at the same time in Sudan, China was attracted to extract the oil originally discovered with some partners who were from East Asia (India/Malaysia), and thus China and its partners were able to extract the discovered oil from six fields [6, 5, 4, 3, 2, 1], and production reached 500 thousand barrels per day and after the secession of the South Sudan, Sudan remained with blocks 6, 4. 2, which produce only 120 thousand barrels per day, adding that the refinery was consuming 120 thousand barrels and half of this quantity belongs to the investing companies (CNPC), indicating that the government bought the companies’ share according to the agreement and but failed to pay the value and the debt accumulated and amounted to more than 3 billion dollars so far.

Ishaq added that after the December Revolution and the emergence of freedom and change, attention was paid to the slogans [freedom, peace, justice] without concern for the economic aspect or the Chinese role, and tended towards the European side and America, and these groups’ priorities were to get rid of any trace of Islamists or Islam with liberal agendas, women’s rights (CEDAW), led by leftist Freedom and Change groups, without regard to economic conditions – especially since American companies have a lobby with the American government to get rid of the Chinese presence – and China being aware of this, reduced spending on managing the remaining productive wells.

Sudan’s potential

The former Minister of the Ministry of Petroleum, Ishaq Jamaa, criticized Sudan for neglecting the Chinese side and continued, “In Sudan, instead of balancing the major powers according to our interests, we neglected the Chinese side.”

However, he stressed that there is still an opportunity to explore more oil in northern Sudan, revealing that there is Locations of blocks 8 – 24 and it is possible to produce up to a million barrels if we can convince the Chinese of that and settle the debt, pointing out that the amount of debt is not large in terms of the size of the countries, and also China has gained huge profits from previous operations, and the agreement is free of any taxes as prices rise at a time was reduced from Us$15 per barrel at the start of production in 1999 to US$100 per barrel by 2002. Ishaq ruled out the possibility of China entering into financing and recovering debts, and conditioned this on the ability of the Minister of Finance and his assistants to negotiate efficiently, noting that China possesses a surplus capital of more than a trillion dollars in the form of shares and bonds in American institutions.

How to pay off debts

For his part, Dean of the Faculty of Economics at Sudan University, Dr. Abdul-Azim Al-Mahal said that China was Sudan’s largest partner and financed Sudan’s oil in addition to some infrastructure projects and agricultural projects, and the trade balance was in favor of Sudan before the secession of the South. After the secession of the South, the trade balance became in favor of China, and debts accumulated on Sudan, and postponement and delay began, and debt interest became more than the original debts, and he believes that the best way to pay off China’s debts is through debt swaps with the BOOT system, meaning that China has an amount of ten billion dollars on the side of Sudan, so China can build for us ten agricultural industrial cities that it will exploit for ten years, clearing its debts, eliminating the cost of the projects, extracting their profits, and operating These projects are pending payment, noting that after that the projects will be transferred to the government of Sudan, after which Sudan will have established projects and paid its debts to China. He suggested establishing railway lines within the framework of the projects, or electricity stations or other fields.

He downplayed the possibility of Sudan to repay these debts in the current situation, and stressed that this would definitely result in the accumulation of interest, and stressed the need of negotiations with China and joining the BRICS.